does tennessee have estate or inheritance tax

What is the inheritance tax rate in Tennessee. No estate tax or inheritance.

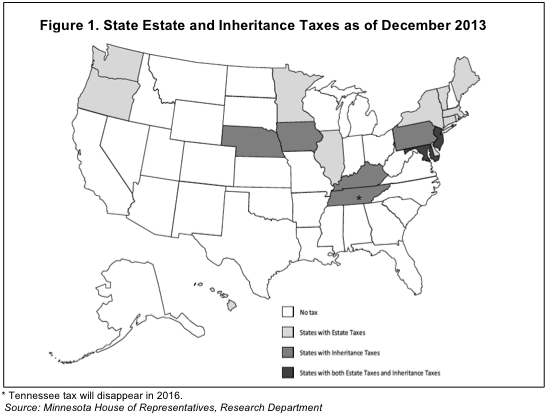

State Estate And Inheritance Taxes Itep

All inheritance are exempt in the State of.

. Tennessee is an inheritance tax and estate tax-free state. Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death. Tennessee does not have an estate tax.

With the elimination of. Connecticuts estate tax will have a flat rate of 12 percent by 2023. For example the neighboring state of Kentucky does have an inheritance tax.

Connecticuts estate tax will have a flat rate of. It is one of 38 states with no estate tax. The net estate is the fair market value of all.

For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply. Tennessee is an inheritance. Tennessee used to impose its own estate tax which it called an inheritance tax This tax ended on December 31 2015.

If the person passed away in 2015 and value of the decedents gross estate was. For deaths occurring in 2016 or. Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes.

It has no inheritance tax nor does it have a gift tax. Only seven states impose and inheritance tax. There are NO Tennessee Inheritance Tax.

Today Virginia no longer has an estate tax or inheritance tax. For all deaths that occurred in 2016 and thereafter no Tennessee inheritance tax is imposed. The Tennessee Inheritance Tax exemption is steadily increasing to 2 million in 2014 to 5 million in 2015 and in 2016 therell be no inheritance tax.

Tennessee used to impose its own estate tax which it called an inheritance tax This tax ended on December 31 2015. For example the neighboring state of Kentucky does have an inheritance tax. Those who handle your estate following your death though do have some other tax returns to take care.

Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. Today Virginia no longer has an estate tax or inheritance tax.

Tennessee is an inheritance tax and estate tax-free state. It has no inheritance tax nor does it have a gift tax. Up to 25 cash back Update.

Even though this is good news its not really that surprising.

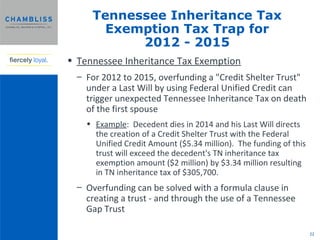

Chambliss 2014 Estate Planning Seminar Pptx

New Year No Taxes Well Tennessee Estate Taxes That Is Tressler Associates Pllc

State By State Estate And Inheritance Tax Rates Everplans

Estate And Inheritance Taxes By State In 2021 The Motley Fool

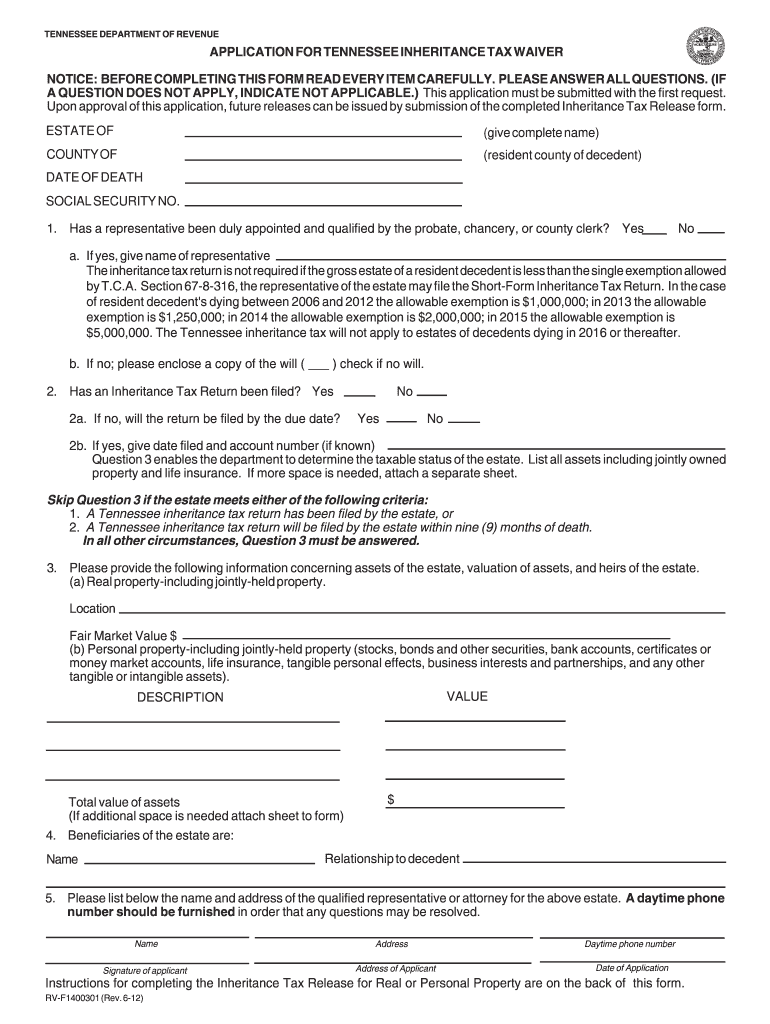

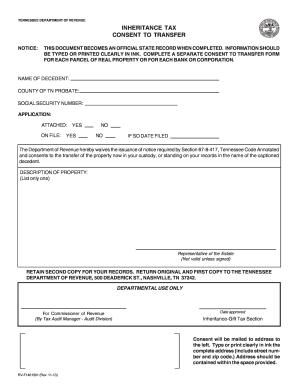

Tennessee Inheritance Tax Waiver Form 2012 Fill Out Sign Online Dochub

State Estate Tax Rates State Inheritance Tax Rates Tax Foundation

Tennessee Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Tennessee Inheritance Tax Repealed Estate Planning Review Nashville

What Happens If You Die Without A Will In Tennessee Epstein Law Firm Blog

State Estate And Inheritance Taxes Itep

Here Are The States With No Estate Or Inheritance Taxes

Tennessee Taxes Do Residents Pay Income Tax H R Block

Is There A Tennessee State Estate Tax Mendelson Law Firm

A Guide To Tennessee Inheritance And Estate Taxes

Tennessee Inheritance Tax Repealed Estate Planning Review Nashville

Money Inheritance Document Pdf Form Fill Out And Sign Printable Pdf Template Signnow

New York S Death Tax The Case For Killing It Empire Center For Public Policy